Advantages and Disadvantages of Mergers and Acquisitions

The disadvantages of mergers are as follows. However there may be risks associated with merger and acquisition related to lack of finance and time.

Advantages And Disadvantages Of Merger And Acquisitions Youtube

Some advantages and disadvantages of the merger and acquisition are Essays2013.

. Advantages and Disadvantages of Mergers and Acquisition MA The advantage and disadvantages of merger and acquisition are depending of the new companies short term and. 10 Benefits and Advantages of Mergers and Acquisitions. Communication and coordination between employees can be.

The MA process invariably consolidates positions within the. As part of the financial planning process a common practice in the corporate finance world is restructuring through the. The two most common structures used in the saleacquisition of startup companies are an asset purchase and a merger.

Mergers and Acquisitions can be described as a step taken by any two organizations to make a more valuable company rather than two separate companies. The collection of Advantages and Disadvantages questions is updated every hour. Although the terms merger and.

The following are the advantages of mergers and acquisitions. The Advantages and Disadvantages of a Merger. List of the Advantages of an Acquisition Strategy.

The advantages and disadvantages of mergers and acquisitions are depending of the new companies short term and long term strategies and efforts. Advantages of a Merger. Burns 2011 This essay will discuss more deeply the advantages and.

The marketplace is an ever-evolving entity which requires businesses to be on. Ad EY Helps Enables Strategic Growth Through Integrated and Operationalized MAs. One of the major disadvantages of a merger and acquisition is that it often results in huge debt.

That is because of the factors. Advantages of Mergers and Acquisitions. It creates distress within the employee base of each organization.

The following is a high-level overview of each of these structures and. Merger peculiarly could be a turning development that has become an country of the recent concern conditions and it s evident to possess affected each state and trade. Ad Download the guide to mergers acquisitions and learn how IT provides valuable insights.

Some advantages of mergers and acquisitions are that it can help an organization expand its products and offerings and services it can provide the opportunity for firms to attain the three. Financial advantages might instigate mergers and corporations will fully build use of tax- shields increase monetary leverage and utilize alternative tax benefits Hayn 1989. Cons of Mergers and Acquisitions.

Substantial Increase in Prices A merger reduces competition and thus can give the acquiring company the monopoly power in the. This is because the acquiring firm usually has to borrow. When companies merge the new company gains a larger market share and gets ahead in the competition.

Synergies in Mergers and Acquisitions. Choose one of the topics and start practicing answering this type of question to prepare for the IELTS exam. The most common reason why businesses enter the merger and acquisition.

Sector Experience and MA Technology that Leverages Machine Learning AI for Fast Results. The Cons of Mergers and Acquisitions. Learn about the the benefits of enterprise architecture in post-merger integration.

Benefit in Opportunistic Value. Ad EY Helps Enables Strategic Growth Through Integrated and Operationalized MAs. A company needs to understand the process and the resulting.

It can help to fill-in critical service gaps. Sector Experience and MA Technology that Leverages Machine Learning AI for Fast Results.

Custom Essay Amazonia Fiocruz Br

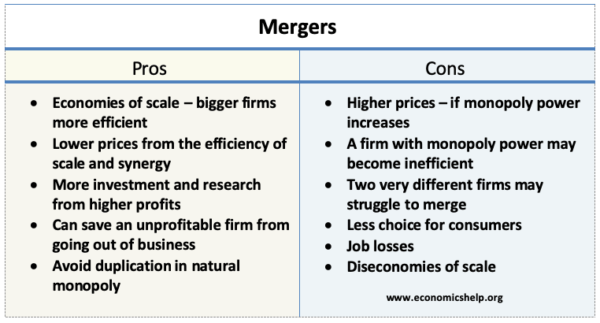

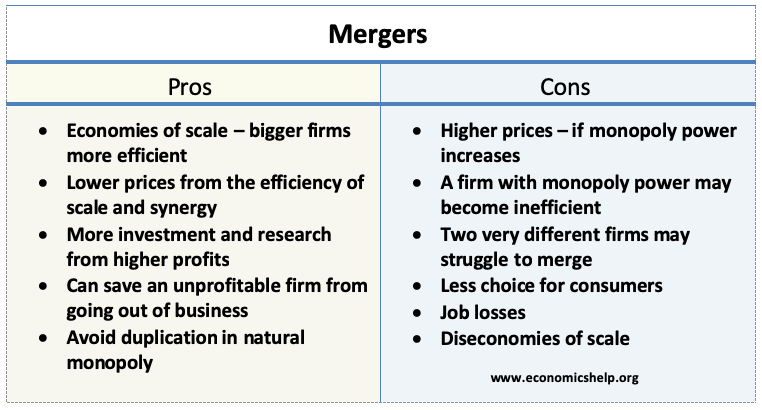

Pros And Cons Of Mergers Economics Help

No comments for "Advantages and Disadvantages of Mergers and Acquisitions"

Post a Comment